Curious if gold is cheaper in the USA or India? Discover real price differences, taxes, purity, cultural trends, and smart tips for gold shoppers in both countries.

When navigating gold import tax, the tax levied by Indian customs on gold that enters the country. Also known as gold duty, it directly pushes the final price you pay at the jeweller. Customs duty, a percentage of the declared value of imported gold is the first cost layer, and it varies with the metal's purity. On top of that, GST on gold, the Goods and Services Tax applied at 3% on the total landed cost adds another charge before the piece reaches the market. Because the duty schedule ties to gold purity, whether the metal is 24K, 22K, or 18K, knowing the karat can save you a lot of money. The gold import tax therefore forms a chain with customs duty and GST that shapes every price tag you see in Indian jewellery stores.

Indian import regulations, the rules governing paperwork, licensing and valuation of incoming gold are the gatekeepers of the tax process. They dictate whether you need an Import Export Code, a customs bond, or a certification of purity before the metal is cleared. A missing document can trigger penalties that inflate the effective tax rate beyond the standard duty. In practice, the regulation‑duty‑GST trio creates a semantic triple: import regulations influence customs duty, which in turn affects GST calculation. Understanding this flow helps you anticipate hidden costs and plan your purchase timing more wisely.

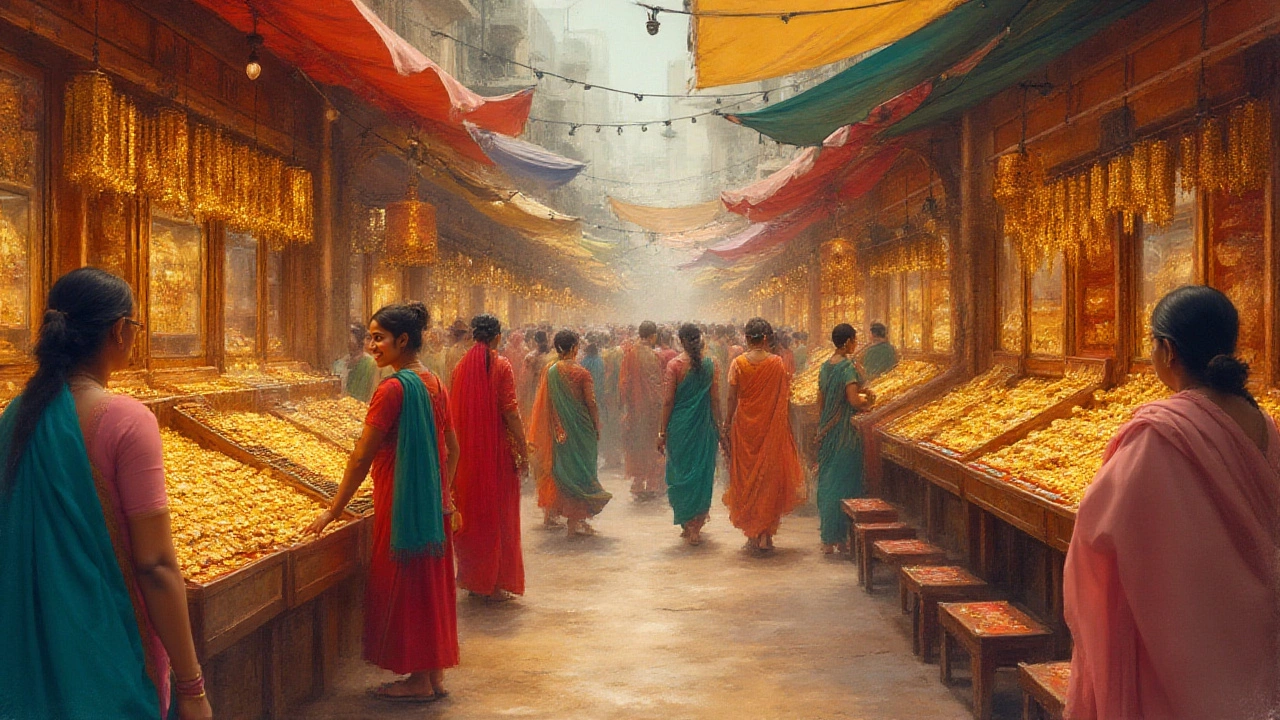

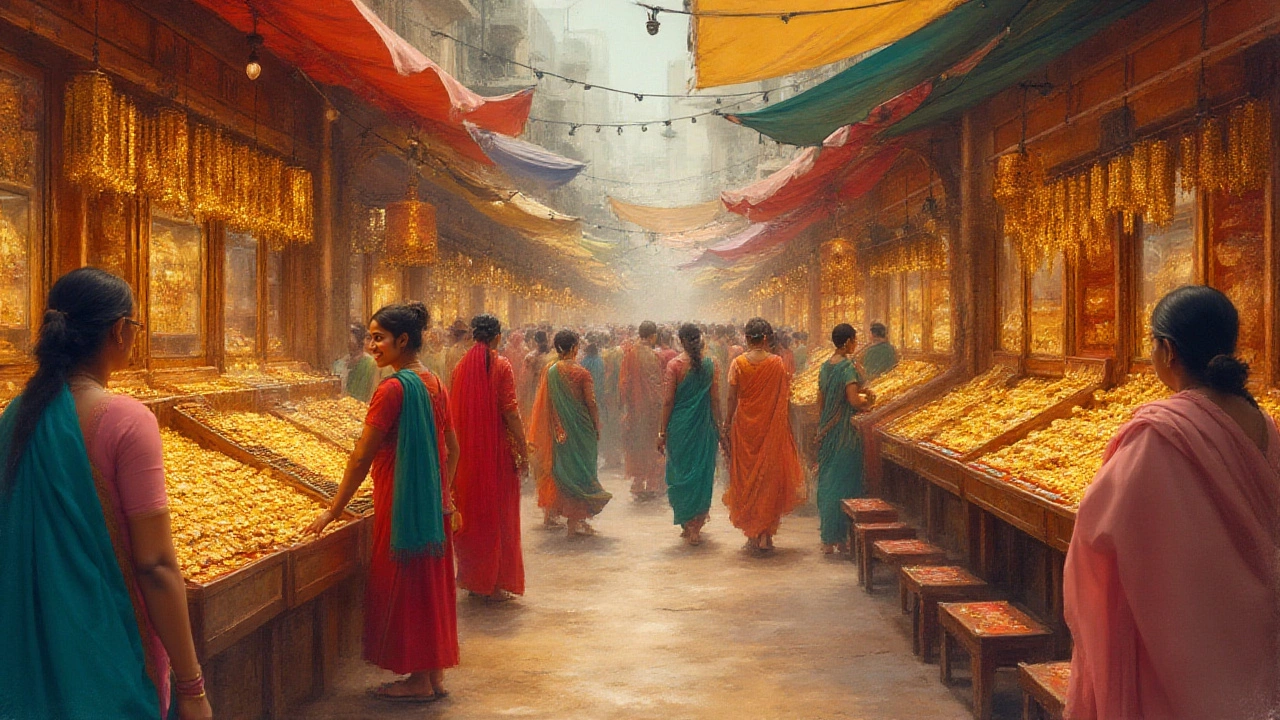

For everyday shoppers, the practical impact shows up as price swings on popular pieces like one gram gold jewellery, small gold items that cost roughly the current market rate per gram plus taxes. When the government tweaks the customs duty from 7.5% to 10%, you’ll notice a direct rise in that one‑gram price. Likewise, any change in GST (for example, a temporary reduction during festive seasons) instantly lowers the checkout amount. This cause‑effect relationship—gold import tax ↔ customs duty ↔ GST—explains why jewellery prices can feel volatile even when the global gold price is stable.

If you’re looking to reduce the tax burden, a few strategies work well. First, verify the purity stamp (like 750 for 18K) before purchasing; lower‑purity gold attracts a slightly reduced duty. Second, buy from dealers who source gold through authorized importers—these sellers often have duty‑paid inventory, meaning the tax is already baked in and you avoid surprise levies. Third, keep an eye on government notifications; occasional duty rebates for specific regions or buyer categories can shave off a few percent instantly. Each tip leans on the semantic connection between purity, duty rates, and final price, giving you a clearer path to affordable elegance.

Below you’ll find a curated list of articles that dig deeper into each piece of this puzzle. From detailed breakdowns of customs duty formulas to real‑world examples of how GST changes impact one gram gold jewellery, the posts cover every angle a smart buyer needs. Dive in to see how understanding gold import tax can turn a complex tax maze into a simple, cost‑saving habit.

Curious if gold is cheaper in the USA or India? Discover real price differences, taxes, purity, cultural trends, and smart tips for gold shoppers in both countries.