You know that wild rush for gold every time prices dip? Picture crowds thronging markets from Manhattan to Mumbai, calculators out, comparing what a single ounce—or gram—of gold will cost them. For a long time, people have sworn you get a better deal on gold in India. But is that really true?

Here’s something that might surprise you: the price tag you see for gold at stores in New York or New Delhi is only the tip of the iceberg. Underneath that sparkling surface sit taxes, import duties, purity standards, and wild currency swings. Maybe your cousin proudly showed off coins bought on a family trip to the US. Or perhaps you’ve heard family elders insist gold jewelry shopping in India always gives more glitter for your buck. With so much hearsay, it’s easy to get tripped up. Dig in, and you’ll see that gold, for all its ancient timelessness, is wrapped up in a very modern tangle of costs, rules, and politics.

How Gold Prices Are Set: Behind the Numbers

Let’s bust a myth first. Gold doesn’t actually “cost” less in one country versus another because the global gold price—called the spot price—updates 24/7, everywhere. This price is set in London, based on real-time international trading. So, whether you’re in Dallas or Delhi, the starting line is the same. At any minute, one troy ounce (31.1035 grams) is theoretically worth the same worldwide. Yet, go shopping and you’ll see very different numbers on the receipts.

So, what really affects how much you pay at your local store? Here are the biggies:

- Currency Rates: Gold is always priced in dollars per ounce. If the rupee weakens against the dollar, Indians instantly feel gold getting pricier.

- Duties and Taxes: This is where things get spicy. The Indian government slaps a heavy import duty on all gold entering the country. As of mid-2025, the basic customs duty is around 15%—plus a 3% Goods and Services Tax (GST) on top. In the USA, there’s no federal import tax on gold bullion, and state taxes vary wildly (some states charge sales tax on gold jewelry or coins, many don’t).

- Purity and Hallmarking: In India, you’ll find everything—22K, 24K, and plenty of pieces without any guarantee stamp. In the USA, the market expects highly accurate purity and transparency, and the government closely regulates it.

- Making Charges: The labor and craftsmanship fees in India can vary by shop, region, and style. Handcrafted bridal sets rack up big making charges. In the USA, high labor costs are balanced by factory-made chains and popular minimalist designs.

Those hidden details often make a bigger difference than the spot price on the evening news. According to the World Gold Council, “local premiums, taxes, and currency rates can sometimes make retail gold up to 20% more expensive for the end buyer than the spot price.”

Why Indian Gold Prices Feel So High: Taxes, Premiums, and the Love of Gold

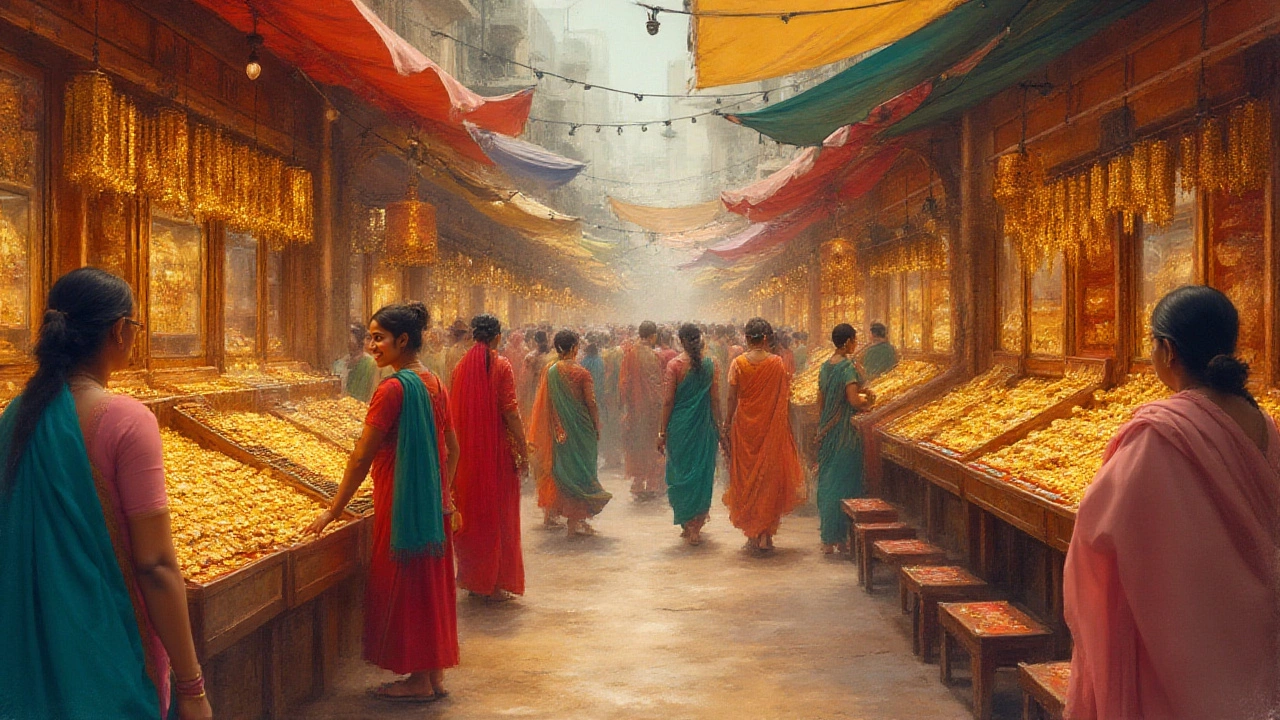

Walk into any jewelry bazaar in India during the wedding season and the energy is unmatched. Gold isn’t just bling—it’s family savings, bride’s backup plan, and a show of status. India’s obsession with gold is legendary. It’s the second-largest consumer in the world (just behind China), buying up about 700-800 tons a year.

So why do Indians pay more at the counter? First up, government policy. Gold isn’t mined much in India, so almost every gold bar or coin is imported. Each gram gets hit with taxes before it ever hits the jewelry workshop. Customs duty started creeping up a decade ago, aiming to stabilize the rupee and nudge people towards other investments. And while the import tax has hovered between 10-15% for years, there’s also a 3% GST layered on the final sale price at your jeweler. Some local VAT or state-level sales taxes may further stack on, depending on the state. All told, at least 16-18% of the price you’re paying isn’t for the gold—it’s for taxes.

But taxes alone aren’t the whole story. Indian jewelers also charge a premium locally called the "retail margin." That covers business overhead, but also excess demand—let’s face it, during festival or wedding season, shops charge more because they can. Making charges, as any Indian buyer knows, can be 7-20% for fancy, detailed ornaments. Stone-studded or intricate pieces hike this up even further. Add up taxes, premiums, and making charges, and the final price per gram can be 20-25% above the global rate. That’s why, even if you spot the same chain stateside, you’ll probably pay a fair bit more for it, gram to gram, in India.

There’s a flip side, though. Indian jewelers will often give you “exchange value”—meaning, they’ll let you trade back old ornaments when you want a new design, subtracting only the making charge and a small deduction for wear and tear. This culture of “gold as security” offsets some premium pain for many families.

Buying Gold in the USA: Transparency and Fewer Hidden Surprises

Step into a major US city’s jewelry district or a trusted bullion dealer, and you’ll see digital boards updating gold prices by the minute, pegged close to international rates. Shopping for gold in the USA is way more straightforward about taxes and purity. Federal law doesn’t put any import tax on gold bars or coins—though some paperwork is needed to prove the source for large amounts. But unlike India, there isn’t a culture of buying gold just for family networks or gifts; investors and hobbyists mostly buy coins, bars, or simple jewelry.

The big thing that works in your favor as a gold shopper in the US? State sales taxes. There’s no national sales tax like the GST—each state makes its own rules. About 41 states fully or partly exempt bullion from sales tax (think Texas, Delaware, Oregon). But if you’re buying jewelry for fashion or gifting, some states will tax you anywhere from 2% to nearly 8% of the total price (like in California). So, if you want the best deal, pick a dealer in a tax-free state or look for “coins and bars” rather than decorative jewelry.

Making charges tend to be lower for simple pieces, especially mass-produced chains, bands, or coins. Labor costs are higher in the US, but most gold sold is 14K or 18K purity because Americans buy gold more for style than savings. 24K jewelry is rare (it’s soft and bends easily), while Indian markets proudly sell 22K for that rich yellow look. “The price premium on gold jewelry in the US is slimmer compared to India, especially on plain coins and bars," says Jeff Christian, managing partner at CPM Group, quoted in

“For Indians, the love for gold adds layers of cost, but for Americans, gold is mostly about price and practicality. Here, premiums above the global rate are lower on average, unless you’re buying luxury designer jewelry.”

One hidden tip? If you’re bringing gold back from the US to India, customs officials at airports have strict limits; as of 2025, Indian citizens can legally bring in up to 20 grams duty-free if they’ve stayed abroad for more than a year, and little else beyond pays crushing import fees.

Smart Tips and Real-Life Scenarios: What Gold Shoppers Need to Know

Some people think it’s easy: just hop on a flight, buy a bunch of gold in the US, come home richer. Reality check—import rules can trip you up, and the math might not work out unless you’re really dodging the system (which you shouldn’t). Customs at Indian airports x-ray travelers’ bags, so what seems like a good plan on paper gets costly fast if you’re caught exceeding the limit. Add the risk of theft, hassle, and exchange rate losses, and the dream wobbles pretty fast.

But if you live in the USA or are traveling anyway, you may be tempted to take advantage of clear pricing, lower premiums, and transparent purity. While you might save on taxes and making charges by buying a gold coin or simple chain from a reliable dealer, you still want to look out for:

- Hallmarking: Look for stamps like “999” (pure), “917” (22K), or US-specific marks. Don’t just go by what the seller says.

- Dealer Reputation: In both countries, stick to well-reviewed jewelers. In the US, places like APMEX, JM Bullion, and local stores with in-person service rate highly.

- State Tax Laws: Ask your jeweler upfront about any state sales tax, especially if you’re buying jewelry rather than coins or bars.

- Buy-Back/Resale Options: In India, buy-back is part of the culture; in the US, it’s common with coins or bars, but selling back used jewelry might fetch less than the market price.

- Exchange Rates: Even if gold looks cheaper in the US, a big swing in the dollar–rupee rate can eat up your savings.

- Legal Limits on Importing Gold: Indians flying in from abroad often find their best deals evaporate at airport customs if they bring in more than the allowed amount.

There’s another angle, too—trends. More young people in both countries are skipping heavy jewelry sets for minimal, wearable designs, or even digital gold investments. But if you’re the sort who values keeping physical gold, don’t just chase the lowest price; think about what you’d do if you ever needed to sell or exchange it. Indian families will trade in old jewelry for new pieces over years. In contrast, Americans are more likely to own gold coins as a stash for a rainy day, rarely touching or trading them except in a true emergency.

To sum it up, buying gold in India looks more expensive on paper (and often is, for jewelry buyers), but the culture and buy-back promises even things out over time. The USA offers better deals on plain coins and bars, less on elaborate necklace sets, and much more transparency. What matters most is knowing the hidden layers of cost, wherever you shop. The shine is only half the story—the fine print decides what your gold is really worth.